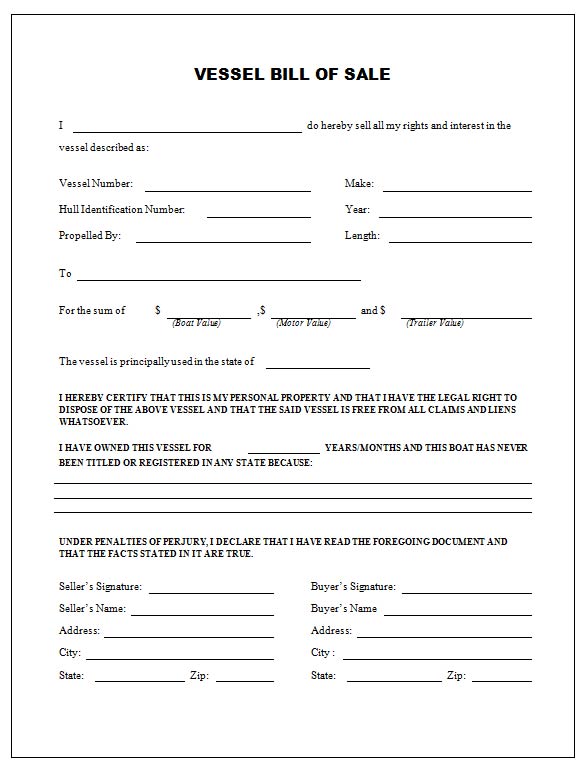

The south carolina use tax is a special excise tax assessed on property purchased for use in south carolina in a jurisdiction where a lower (or no) sales tax was collected on the purchase.. the south carolina use tax should be paid for items bought tax-free over the internet, bought while traveling, or transported into south carolina from a state with a lower sales tax rate.. I am buying a documented 38 tiara from a guy in ny. i live in south carolina. the tax on documented boats in sc is capped @ $300. however they have personal property tax each year thereafter $$$. so i want to pay sales tax in sc then move the boat to nj.. South carolina who is not responsible for collecting sales or use tax. the purpose of this document is to provide detailed information concerning the application of the casual excise tax or use tax, if any, on motor vehicles, motorcycles, boats, motors, airplanes, trailers,.

For boats that are "used in interstate commerce," spend 30 or more days per year in the state and have developed a taxable situs in at least one other state, south carolina imposes an apportioned tax.. If i purchase a boat in another state and store it in south carolina can i pay south carolina sales - answered by a verified tax professional we use cookies to give you the best possible experience on our website.. Generally, there are three taxes of concern to boat owners: sales tax, use or registration tax, and personal property tax. sales tax is imposed, if at all, at the time of purchase. use tax is imposed by sales tax states on goods that were not taxed at the time of purchase..